Articles in English

Yonhap | 1-Sep-2023

The South Korean government filed an appeal seeking to cancel an international tribunal’s order to pay compensation to American private equity firm Lone Star Funds with the firm’s sell-off of the now-defunct Korea Exchange Bank.

Public Citizen | 31-Aug-2023

Many free trade and investment agreements allow multinational corporations to undermine democracy via a secret pseudo-court system known as Investor-State Dispute Settlement (ISDS).

keywords:

investment | BITs ,

investor-state disputes | ISDS

UNCTAD | 31-Aug-2023

UNCTAD presents a new toolbox to make international investment agreements actively support the shift from fossil fuels to renewable energy sources.

The Indian Express | 28-Aug-2023

As India and the UK inch closer towards finalising a free trade agreement, the contours of the much-debated and contentious bilateral investment treaty are likely to be finalised around the same time as the FTA.

Mining.com | 23-Aug-2023

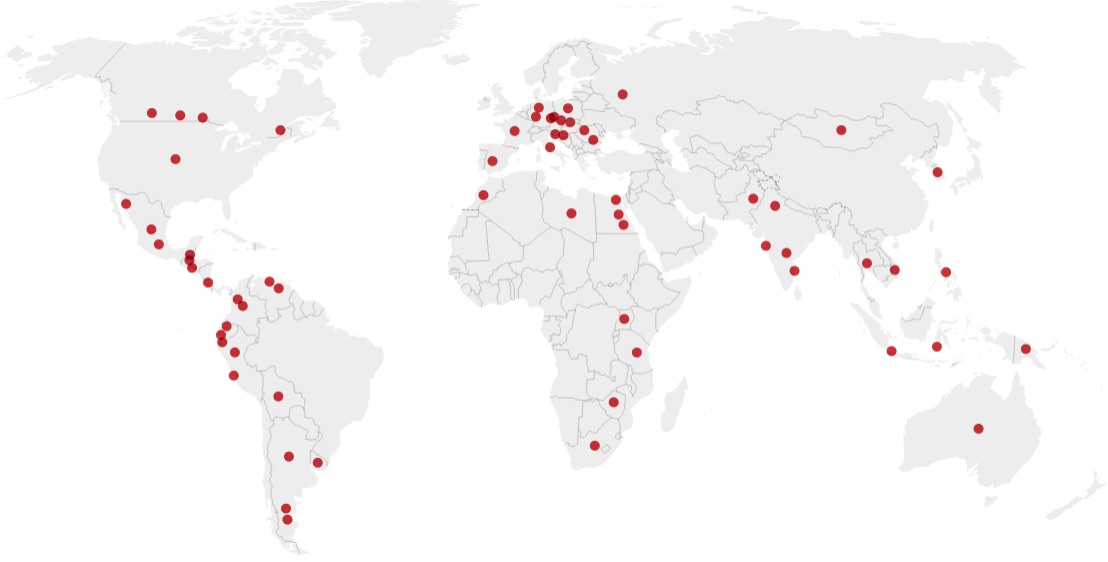

Disputes between governments and investors involving mineral assets are growing rapidly – with 60% of all arbitrations over the last fifty years filed in the last decade, a new study found.

keywords:

investor-state disputes | ISDS ,

mining

Mexico Daily Post | 21-Aug-2023

According to the Ministry of Economy, from 1997 to 2022, 23 lawsuits were concluded against Mexico, where more than 3.362 million dollars were claimed as compensation, within the framework of NAFTA and various investment agreements.

CBC | 21-Aug-2023

Owner of aircraft parked at Toronto’s airport invoking 1989 bilateral investment treaty.

keywords:

Canada ,

investor-state disputes | ISDS ,

militarism | terrorism | security ,

Russia ,

Ukraine

Madhyam | 17-Aug-2023

The experience with investor-state dispute settlement mechanisms has been mixed, with India facing several adverse awards and financial compensation in certain high-profile cases.

Climate Change News | 16-Aug-2023

The Energy Charter Treaty, which Spain is trying to leave, protects investments in fossil fuels and in renewables.

KBS | 16-Aug-2023

US private equity firm Lone Star Funds has filed an application to cancel an international tribunal’s ruling that South Korea pay over 200 million US dollars in compensation.